- Ctrl Alt Finance

- Posts

- Roaring Kitty, China Dumps U.S. Treasuries, and ECB Cuts Rates

Roaring Kitty, China Dumps U.S. Treasuries, and ECB Cuts Rates

The European Central Bank (ECB) is poised to reduce interest rates this week, despite a recent uptick in inflation.

What does this mean for U.S. Markets?

So, the ECB is thinking of slashing interest rates, right? If they do, we might see more money heading to the US for better returns, giving our stock market a nice little boost. Plus, it could weaken the euro against the dollar, making our exports look even more appealing. But hey, let's not forget, what happens next also depends on what the Federal Reserve does, global economic shifts, and what's cooking domestically in the US.

China Dumps US Treasuries Faster Than You Can Say 'It's Not You, It's Me' to Your Ex

China has offloaded $101.9 billion in US Treasuries over the last year, probably trying to reduce its dollar dependency like someone ditching an old flip phone for a shiny new smartphone. Meanwhile, Fed Governor Christopher Waller assures us the dollar isn’t going anywhere, likening its staying power to that of an uninvited guest who just won’t leave. For more details on this financial shake-up, check out the full article here.

Being Human doesn’t have to cost you thousands of dollars

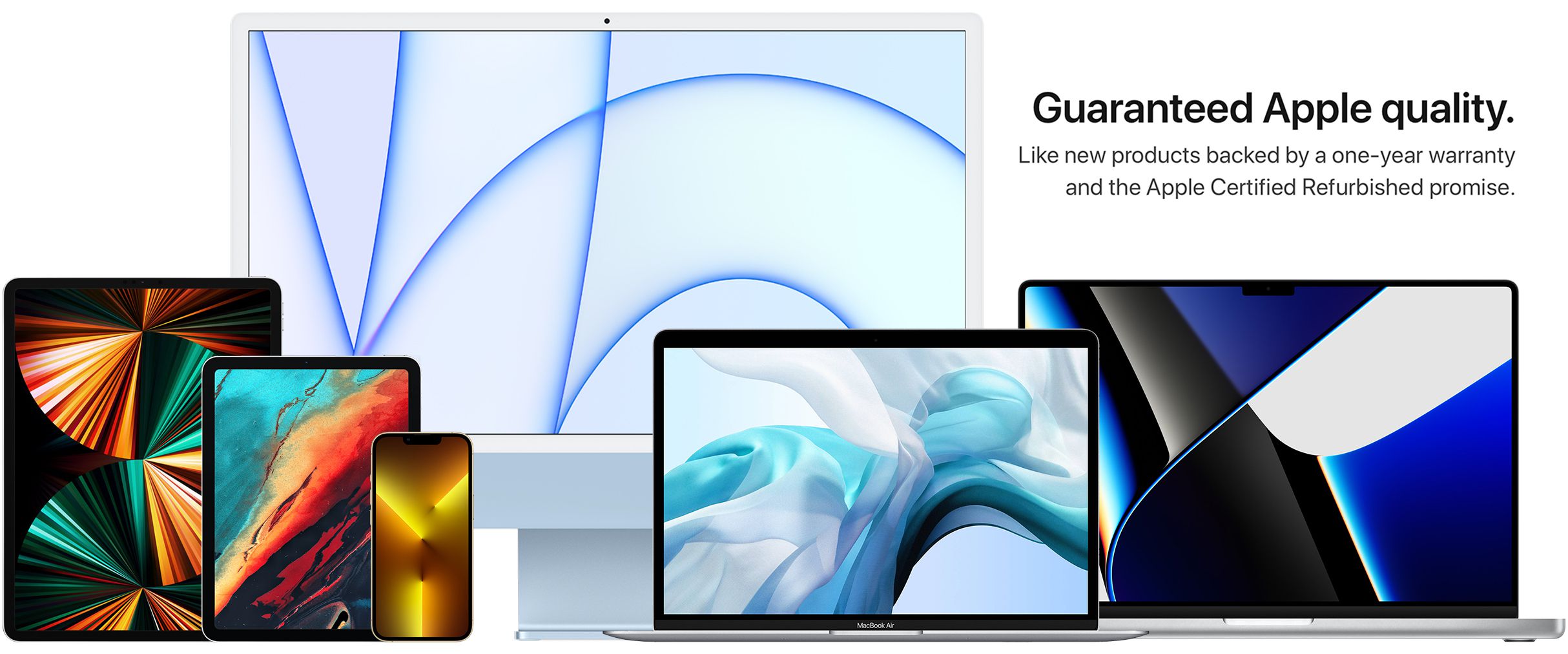

Save Big Bucks on Apple Gear – No One Will Know It's Refurbished!

Buying refurbished Apple products is a great way to save cash without compromising on quality. These gadgets get a thorough check-up, a shiny new box, and come with a year-long warranty. You can save hundreds and still get a device that looks and works like new. Plus, you'll be an eco-warrior, reducing e-waste!

Apple’s refurbishment process includes testing, replacing any worn-out parts with genuine Apple bits, and ensuring everything's in tip-top shape. So, why pay full price when you can get the same product for less? It's like buying new but with extra cash in your pocket!

Check out Apple's refurbished section and see for yourself – your wallet will thank you (Apple) (MacRumors) (MacRumors).

Boost Your Credit: Best Credit Builder Apps

If you're looking to improve your credit score, check out some of the top credit builder apps available. Self and CreditStrong are standout options, both offering secured credit-builder loans where you make monthly payments that are reported to the credit bureaus. Experian Boost is another great tool that helps by adding your utility and phone payments to your credit report, potentially increasing your score instantly. SeedFi combines savings with credit building, allowing you to save while you build credit.

Using these apps can be a smart way to manage your finances and enhance your credit profile, especially if you're starting from scratch or trying to recover from past credit issues. Investing in a credit builder app can be a step toward better financial health and future borrowing opportunities.

For more details and a comprehensive list of the best credit builder apps, visit CreditDonkey.

Melvin Capital & the Game Stop Short Squeeze

You may have heard of Melvin Capital, a hedge fund renowned for its long-short equity strategies and strong early performance. However, its name became infamous following its involvement in the GameStop (GME) short squeeze of early 2021.

In the first quarter of 2021, Melvin Capital found itself at the epicenter of a highly publicized event known as the GameStop short squeeze.

Here’s what happened:

Melvin Capital had taken a significant short position on GameStop, betting that the stock price would decline. Unbeknownst to them, little did they know, they were about to step into a colossal financial shitstorm.

Enter r/WallStreetBets, a large and determined group of retail traders. These investors began buying large quantities of GameStop shares, aiming to trigger a short squeeze. This forced short sellers like Melvin Capital to purchase shares at higher prices to cover their positions, further driving up the stock price.

The collective effort of r/WallStreetBets and other retail investors caused GameStop’s stock price to skyrocket from under $20 per share in early January 2021 to an intraday high of over $480 later that month.

As a result, Melvin Capital got their ass handed to them, losing 53% of their value in January 2021 alone.

In need of a bailout, the fund received a $2.75 billion infusion from Citadel LLC and Point72 Asset Management. Despite this support, Melvin Capital struggled to recover. The fund ultimately decided to wind down operations and return remaining capital to investors, shutting down in May 2022.

That’s it for this week, don’t let the excitement end here - stay tuned for next week!

If you enjoyed this edition, share it with a friend or two, and let's keep the conversation going.

Have feedback or something you'd like to see covered? Drop us a line – we love hearing from you!

Reply